Tax Court Decision Holds Potential Impact for Travel Deductions

2021 Tax Laws, Deductions, Tax News, Tax Planning, Tax Tips, Taxes

There are many professions that require taxpayers to travel extensively and spend significant amounts of time in paid lodging. These expenses are traditionally claimed as travel deductions. However, a case recently heard by the Tax…

Individuals Have a New Opportunity to Receive $500 Economic Impact Payments for Their Children

2020 Stimulus Package, COVID-19, Tax NewsArticle Highlights:

$500 Per Child Stimulus Payment

Non-Filer Tool

Those Who Have Already Used the Non-Filer Tool

Those Who Haven’t Used Non-Filer Tool

How Payment Will be Made

Get My Payment Tool

Non-Filers

The…

How States are Reshaping Nexus Laws for Remote Employees Due to COVID-19

COVID-19, Tax News, Tax Planning, Tax Tips, TaxesEver since the coronavirus pandemic began impacting the United States, businesses around the country have responded by instituting work-from-home policies. While it is unclear how much longer the nation will be in the grips of the crisis, social…

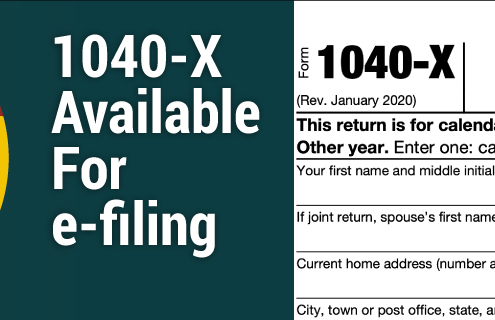

IRS makes Form 1040-X amended tax returns available for e-filing

2020 Tax Laws, Tax News, Tax TipsFrom Michael Cohn, Editor-in-chief @ Accounting Today

The Internal Revenue Service is now letting taxpayers submit Form 1040-X electronically when they want to file an amended tax return through commercial tax software, in what the agency…

Tax Changes For 2019

2019 Tax Laws, Tax News, Tax Planning, TaxesAs the end of the year approaches, now is a good time to review the various changes that impact 2019 tax returns. Some of the changes are likely to apply to your tax situation. In addition, be aware that various tax-related bills currently in…

June Estimated Tax Payments Are Just Around the Corner

2018 Tax Laws, Business, Corporate, Tax News, Tax PlanningJune 15th falls on the weekend this year, so the due date for the second installment of estimated taxes is the next business day, June 17, which is just around the corner. So, it is time to determine if your estimated tax payment should be lowered…

5 Reasons to Amend a Previously Filed Tax Return

2018 Tax Laws, Tax News, Tax Tips, TaxesThe most recent data from the IRS on individual tax returns indicates that of 131 million returns filed, about 5 million were expected to be amended. This comes to less than 4 percent, but that projection still affects a significant number…

SALT Deduction – Battle Lines Have Been Set and Swords Have Been Drawn

Tax News, Tax Tips, TaxesArticle Highlights:

• SALT Tax Limits

• State Work-arounds

• Converting Tax Deductions to Charitable Contributions

• IRS Regulations

• Taxpayer Beware

Tax reform has limited the federal itemized deduction for state…

Do You Need to Renew Your ITIN?

2018 Tax Laws, Tax News, Tax Reform, TaxesThe IRS has announced that more than 2 million Individual Taxpayer Identification Numbers (ITINs) are set to expire at the end of 2018. An ITIN is a nine-digit number issued by the IRS to individuals who are required for U.S. federal tax purposes…

States Sue U.S. to Void $10,000 Cap on State and Local Tax Deduction

2018 Tax Laws, News, Tax NewsFour states – New York, Connecticut, Maryland and New Jersey – have sued the federal government to void the tax-reform cap on the federal itemized deduction for state and local taxes, contending that limiting the deduction is unconstitutional.…