Tax Changes For 2019

2019 Tax Laws, Tax News, Tax Planning, TaxesAs the end of the year approaches, now is a good time to review the various changes that impact 2019 tax returns. Some of the changes are likely to apply to your tax situation. In addition, be aware that various tax-related bills currently in…

Earn Tax-Free Income from Working Abroad

TaxesU.S. citizens and resident aliens are taxed on their worldwide income, whether they live inside or outside of the U.S. However, qualifying U.S. citizens and resident aliens who live and work abroad may be able to exclude from their income all…

Is It Time for a Payroll Tax Checkup?

Business, Employees, TaxesWas your 2018 federal tax refund less than normal, or – worse yet – did you actually owe tax despite usually getting a refund? If so, this was primarily due to the last-minute passage of the Tax Cuts and Jobs Act at the end of 2017. Because…

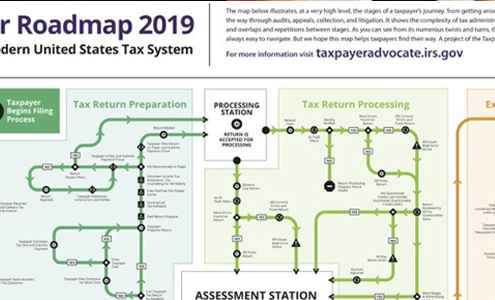

See the US Tax System Illustrated in One Complex Map

TaxesNot sure whether it’s worth your while to hire a tax professional to do your taxes? Thinking that maybe this year you’ll take a run at it yourself? You may want to think again after taking a look at a new graphic released by the Taxpayer…

Employee Stock Options Can be Taxing

Employees, Stocks, TaxesIf you are an employee of a corporation, as an incentive to continue employment, the company may offer you the option to purchase shares of the corporation at a fixed price at some future date so that you can benefit from your commitment to…

Tax Issues Related to Hobbies

Tax Planning, TaxesGenerally, when individuals have a hobby, they have it because they enjoy it and are not involved in their hobby with the goal of making money. In fact, most hobbies never make money or don’t even create any income, for that matter. Tax law…

What Are the Tax Advantages of Homeownership?

Home Ownership, TaxesHousing is a big expense for everyone. The choice generally involves either renting or purchasing – and financing that purchase with a home loan. This article explores the tax benefits and drawbacks that individuals should consider when deciding…

How to Write Off Worthless Stock

Deductions, TaxesIf you are like most investors, you occasionally will pick a loser that declines in value. Sometimes, a security can even become worthless when the issuing company goes out of business.

Gains and losses for securities, including stock,…

Foreign Account Reporting Requirements (FBAR)

Foreign Taxes, TaxesU.S. citizens and residents with a financial interest in or signature or other authority over any foreign financial account need to report that relationship by filing FinCEN Form 114 if the aggregate value of the accounts exceeds $10,000 at…

The IRS Is Cracking Down on Cryptocurrency Tax Transactions

2018 Tax Laws, TaxesThe IRS announced in late July 2019 that it is ramping up its campaign to ensure that taxpayers with cryptocurrency transactions report these transactions on their income tax returns – and report them correctly – by sending “educational”…