Don’t Miss Out on Year-End Tax-Planning Opportunities

2020 Stimulus Package, 2020 Tax Laws, Tax Credits, Tax Planning, Tax TipsArticle Highlights:

Unemployment Benefits Taxability

To Skip or Not Skip the 2020 Required Minimum Distribution

Special Charitable Giving Opportunities

Divorced or Separated Planning Issues

Potential State Health Insurance…

Big Tax Breaks for Hiring Your Children in the Family Business

Tax Credits, Tax Planning, Tax TipsArticle Highlights:

Child Under the Age of 19 or a Student Under the Age of 24

Kiddie Tax

Tax on a Child’s Earned Income

Deduction for the Business

Employment Taxes

IRAs and Retirement Plans

With jobs at a premium during…

Transferring a Primary Residence to Children

2020 Tax Laws, Financial Planning, Gift Tax, Inheritance, Tax TipsFrom the FI Tax Guy

How do you pass your family’s house to your children? It’s a pressing question and involves significant tax, legal, and emotional considerations. Unfortunately, it is a topic about which there is much confusion.

This…

What Happens if I Missed the October 15th Tax Extension Deadline?

Tax Planning, Tax Tips, TaxesWe’ve all been there. Life is super busy. We have to take care of our families and friends, work obligations, and all our other everyday responsibilities. With all of the hustle and bustle, you realize that the October 15th tax extension…

Top 10 year-end tax planning tips

2020 Tax Laws, Accounting, Tax Planning, Tax Tips

From Accounting Today

Between the upcoming presidential election and the COVID-19 pandemic and its attendant stimulus packages, this year has seen more than its share of uncertainty around tax — which makes helping clients…

How States are Reshaping Nexus Laws for Remote Employees Due to COVID-19

COVID-19, Tax News, Tax Planning, Tax Tips, TaxesEver since the coronavirus pandemic began impacting the United States, businesses around the country have responded by instituting work-from-home policies. While it is unclear how much longer the nation will be in the grips of the crisis, social…

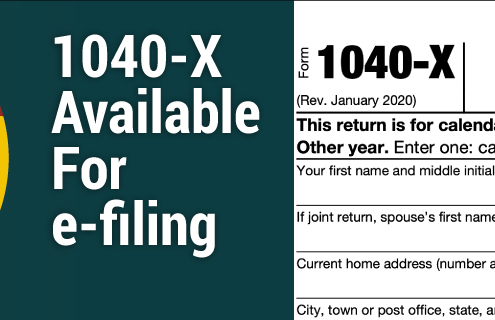

IRS makes Form 1040-X amended tax returns available for e-filing

2020 Tax Laws, Tax News, Tax TipsFrom Michael Cohn, Editor-in-chief @ Accounting Today

The Internal Revenue Service is now letting taxpayers submit Form 1040-X electronically when they want to file an amended tax return through commercial tax software, in what the agency…

Watch Out for Tax Penalties

2020 Tax Laws, Tax Planning, Tax Tips, TaxesMost taxpayers don’t intentionally incur tax penalties, but many who are penalized are simply not aware of the penalties or the possible impact on their wallets. As tax season approaches, let’s look at some of the more commonly encountered…

What President Trump’s Executive Order Means for You

2020 Stimulus Package, 2020 Tax Laws, COVID-19, Tax Credits, Tax Planning, Tax Tips, UncategorizedWe are still waiting for the dust to settle on what President Trump’s executive orders mean for taxpayers and business owners. There is a lot of talk about legal challenges and how Congress may react. But here is a summary of what we know…

Wealthy Taxpayers May Want to Strategize for Potential Tax Increases

2019 Tax Laws, 2020 Tax Laws, Financial Planning, Tax Planning, Tax Tips, TaxesArticle Highlights:

Skyrocketing Government Spending

Federal and State Deficits

Tax Increases in Our Future

Tax Strategies

The outcome of the November elections could have a significant impact on taxes for the wealthy. The COVID-19…